Property Taxes

Since v0.21.0 of Lendiom, keeping record of property taxes is now possible. The following is a guide with detailed descriptions of the various inputs and what the expected result will be. If you want a high level overview, we recommend reading the blog post first.

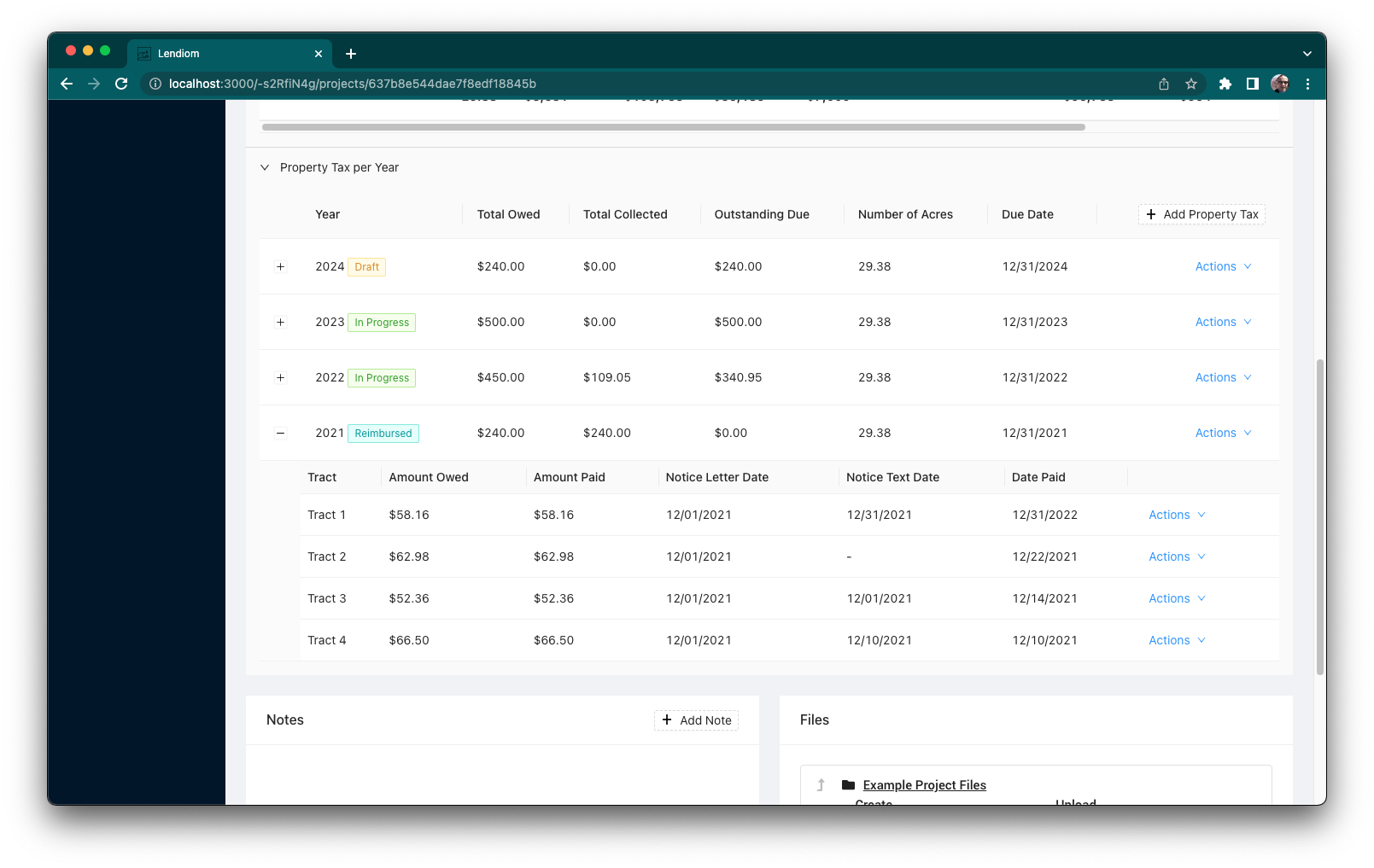

Property Tax Section Overview

Property Tax Status Flow

Once created, a property tax defaults to the Draft status. When finished and ready to send off, the property tax is Finalizing which means that Lendiom is sending off notices. After the notices are sent off, the property tax is set to In Progress. Finally, when every tract tax is paid or marked as paid, the property tax status changes to Reimbursed.

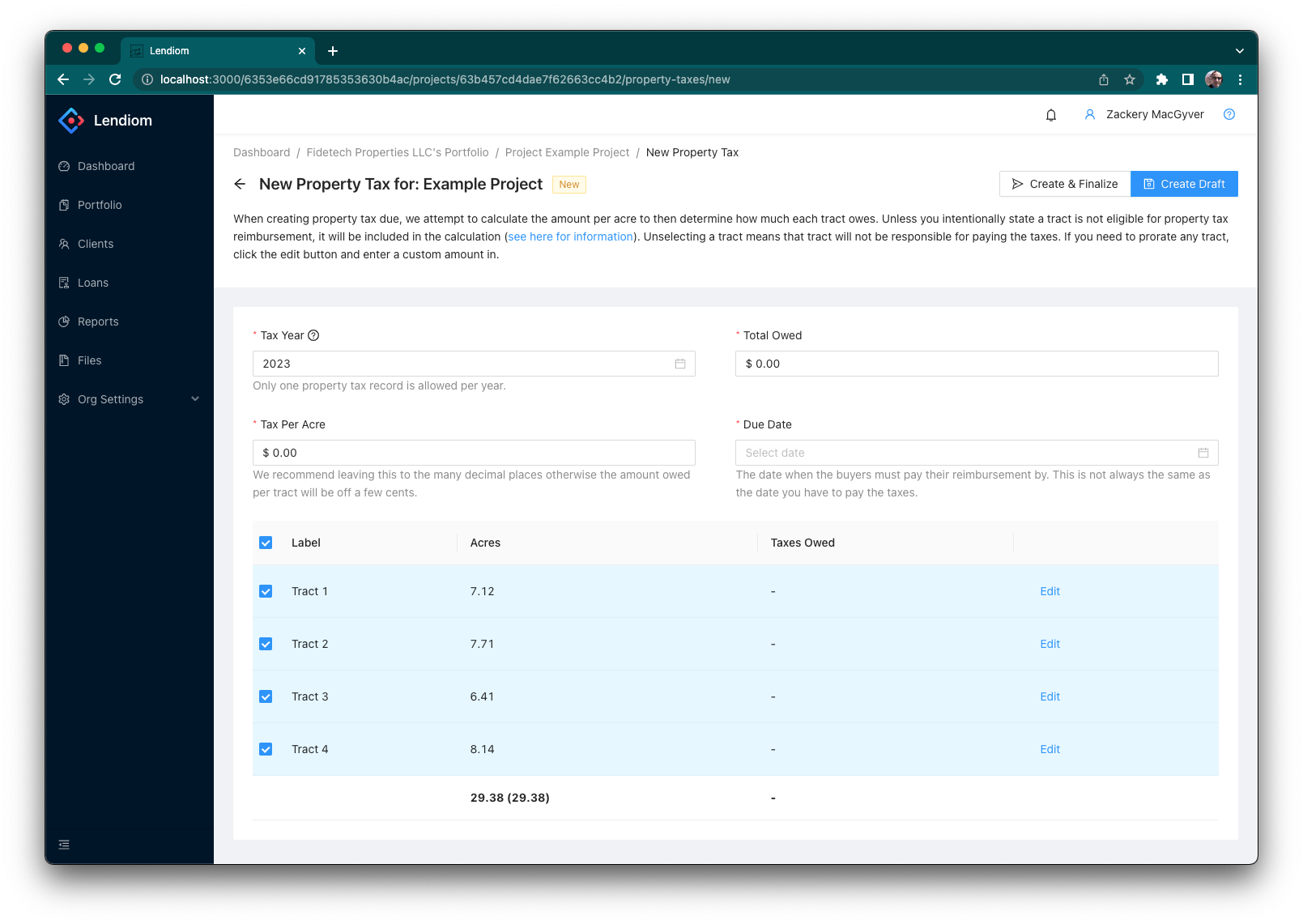

New Property Tax Creation

Below is a screenshot of the screen where you create a new property tax record.

Input Descriptions

While a property tax is in the Draft status, any of these inputs can be changed. However, once finalized none of the values can be changed.

Tax Year

The year in which you, the seller, have been billed for the property taxes. We only allow one property tax per year per development.

Total Owed

How much property tax you owe and how much you need to be reimbursed for.

Tax Per Acre

The amount of tax owed per acre. We calculate this based on the number of acres the project has and the total owed. The calculated amount will have several decimal places and we highly recommend keeping it as auto calculated.

Due Date

When must the buyers have paid/reimbursed the property tax by? Lendiom will include this date in the notices and will send an automated reminder on the due date if the buyer has not paid it yet.

Tracts Table

Underneath the top inputs is a list of all the tracts in the development. The columns are:

- Checkbox

- Tract Label

- Tract Acres

- Taxes Owed

- Edit Button

The checkbox indicates whether or not that tract is included as part of the property tax bill. When this is unchecked, no notices will be sent to the tract's owner nor will we expect any payment from them. If a tract has the option Eligible for Property Tax Reimbursement set to Not Eligible then that tract will not be included as part of the tax bill. By default, every tract has this enabled and can be disabled manually on a tract by tract basis.

The taxes owed are automatically calculated based on the tax per acre and the amount of acres the tract has. However, this can be a custom amount if you click the Edit button.

At the bottom of the tracts table is the summary row. The first value there has two numbers, for example: 29.38 (29.38). The first amount is the acres which have been included in the taxes owed. The second amount is the total amount of acres for the development. The second value on the summary row is the sum of the taxes owed per tract.

Custom Tract Tax Amount

Whenever you click the Edit button on a tract, a simple editor will pop up and you can enter the custom amount.

Once you have a custom amount, a Reset button will appear. This allows you to easily remove the custom amount you applied and resets the taxes owed for the tract to be the per acre calculated amount.

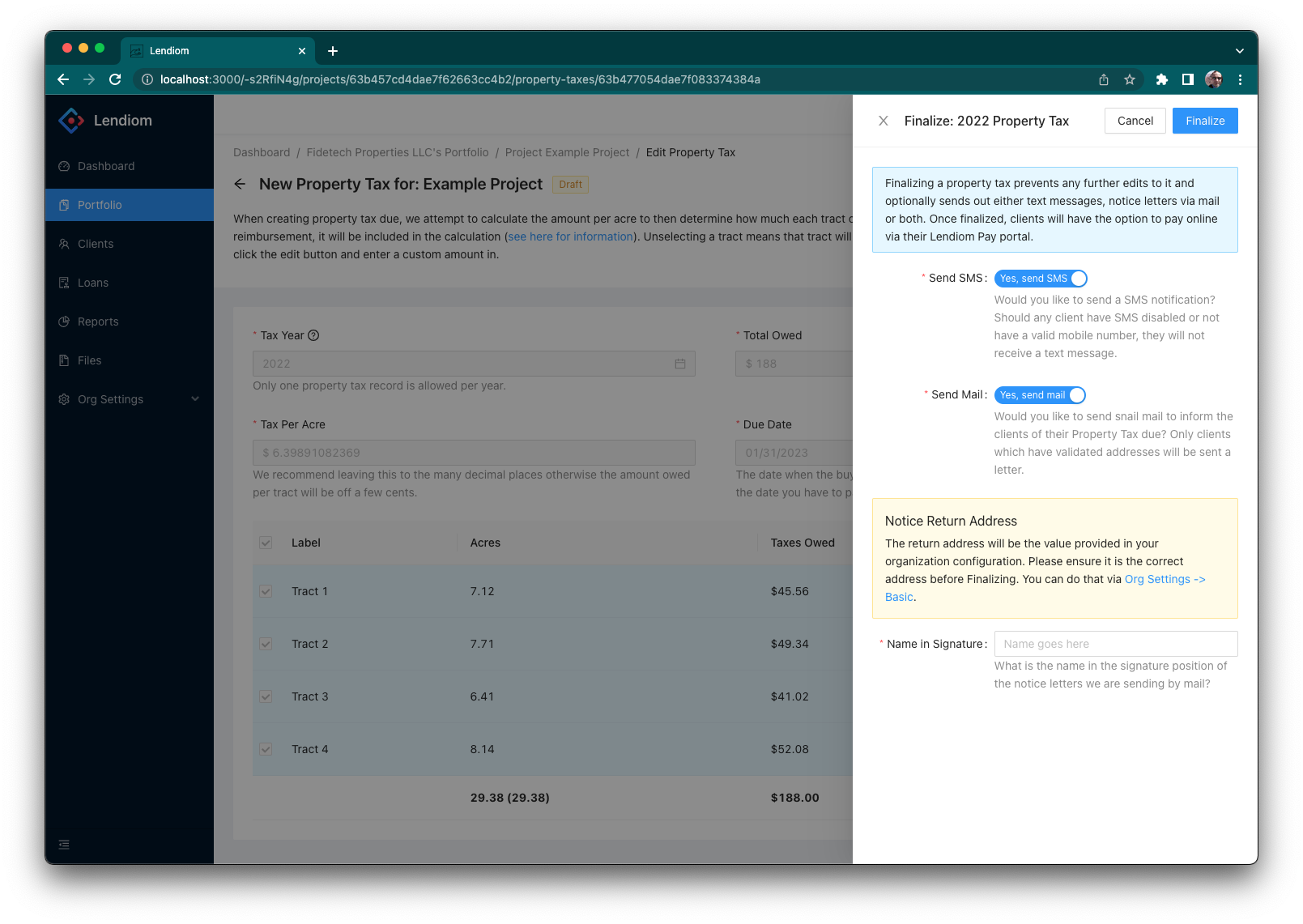

Finalizing Screen

After you have created the property tax, you will need to finalize the property tax so that the buyers can pay you and you get reimbursed. The following is a screenshot of the finalize screen:

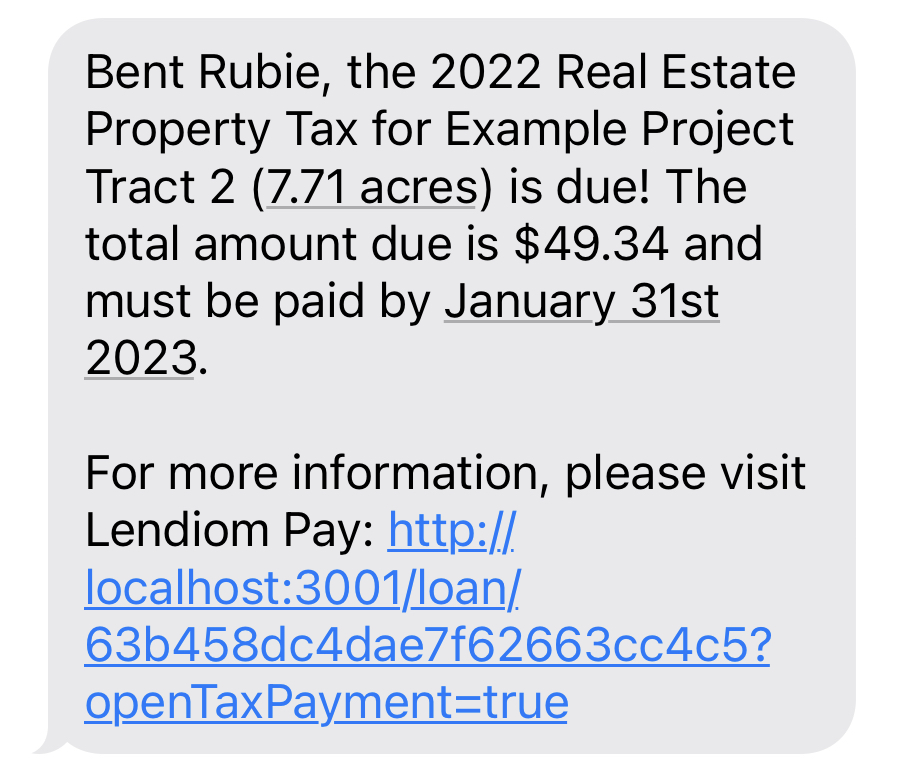

Send SMS

The Send SMS option enables Lendiom to send text message notices to the buyers of each tract if they have a valid phone number. As this is outside of their loan and this is not an automated message, we will send the message regardless of their automated messaging choice on the loan. The following is a screenshot of the text message the buyer will get. (note: if the buyer does not have a loan in the system, they will not have the option to pay online)

Send Mail

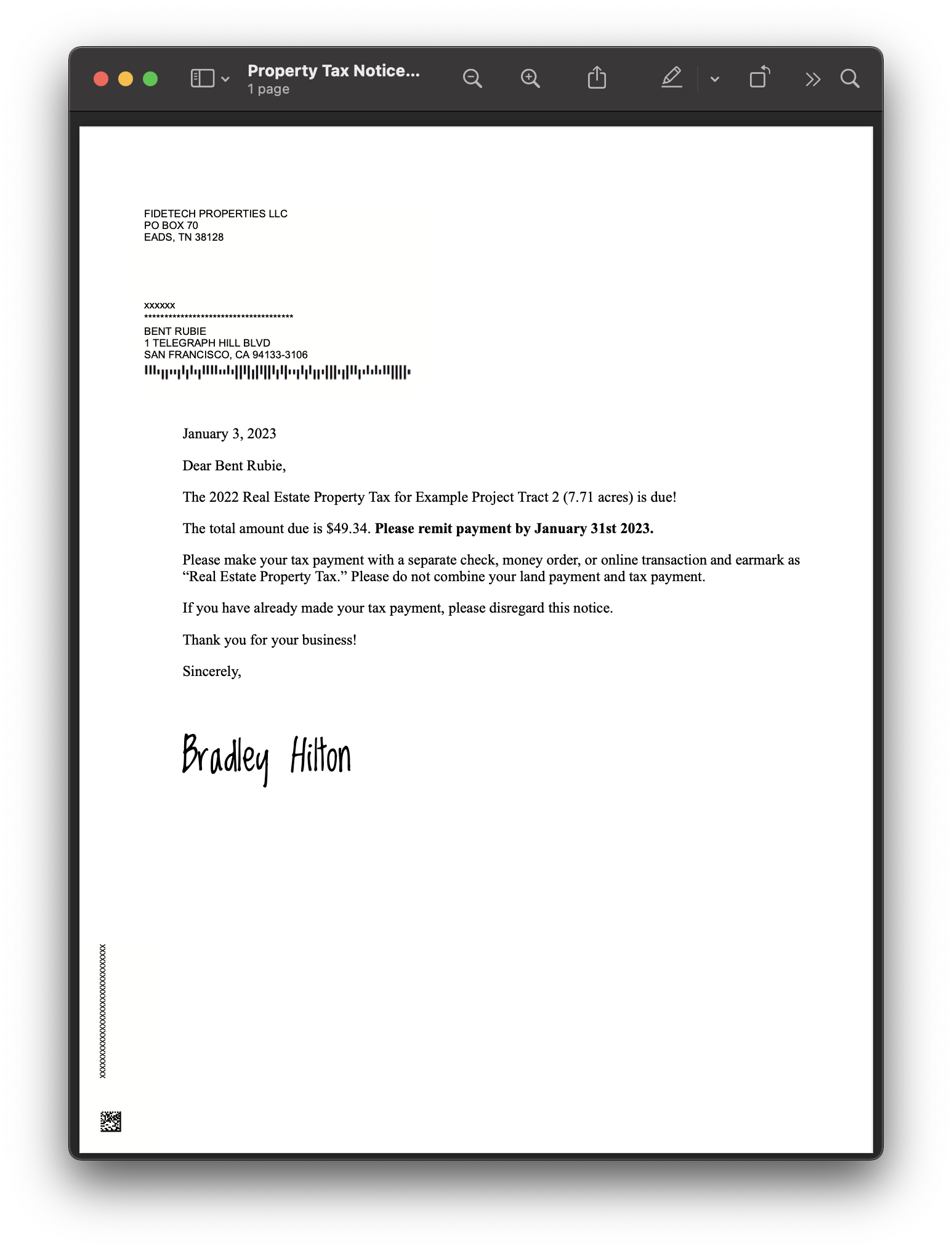

The Send Mail option enables Lendiom to send a notice letter via the mail to the buyer of each tract if they have a valid address on file. The following is a screenshot of the notice letter sent to the client.

The return address printed on the notice letter will be the Mailing Address address you have configured in the Organization Settings underneath the Basic section. Please verify this is the value you want printed on the notice letters.

Name in Signature

If the Send Mail option is enabled, then you will need to input the name that goes in the signature position on the letter.

Customer Paying

For customers who have a loan inside of Lendiom, they will be able to pay inside of Lendiom Pay. Please see the Lendiom Pay guide related to Paying Property Taxes.