Happy New Year! We want to take this time and thank all of our customers for a successful 2022. Throughout the year we added lots of new features, fixed several bugs and, overall, improved the stability of the product.

As we bring in the new year, we are pleased to announce a new feature: Property Tax for owner financed developments!

Read on for more information and screenshots!

Lendiom

Generally, any time an unimproved piece of real estate is owner financed with a contract for deed, the seller gets the bill for property tax, pays it and then sends an invoice/notice to the buyer for reimbursement. With this new feature in Lendiom, we are making it easy for sellers to keep record of their property tax bills and the status of the reimbursements.

As part of this feature, Lendiom takes care of the following:

- Sending text message notice

- Sending notice letter via mail

- Sending reminder on due date if not paid

- Accepting reimbursement in Lendiom Pay from the buyer

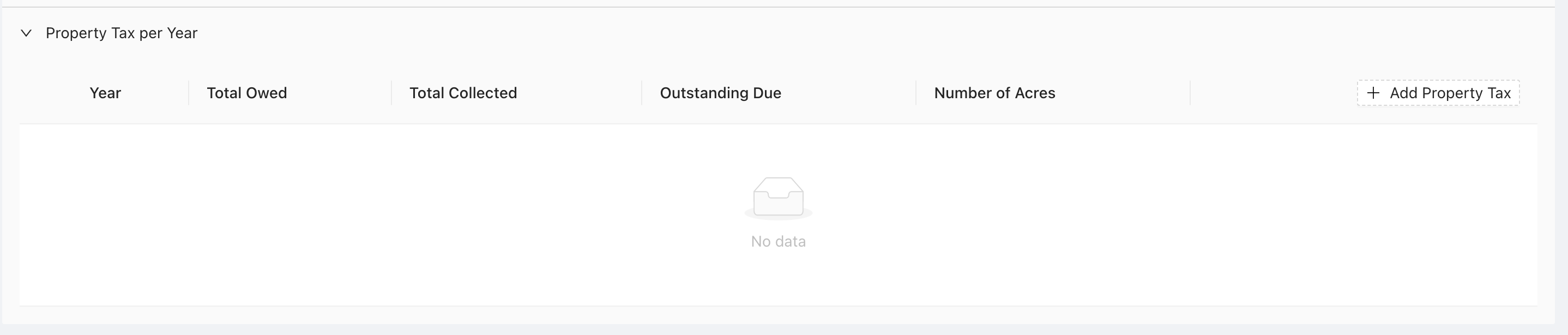

Inside of Lendiom there is a new section on the development page underneath the tracts called Property Tax per Year. It must be clicked on to expand:

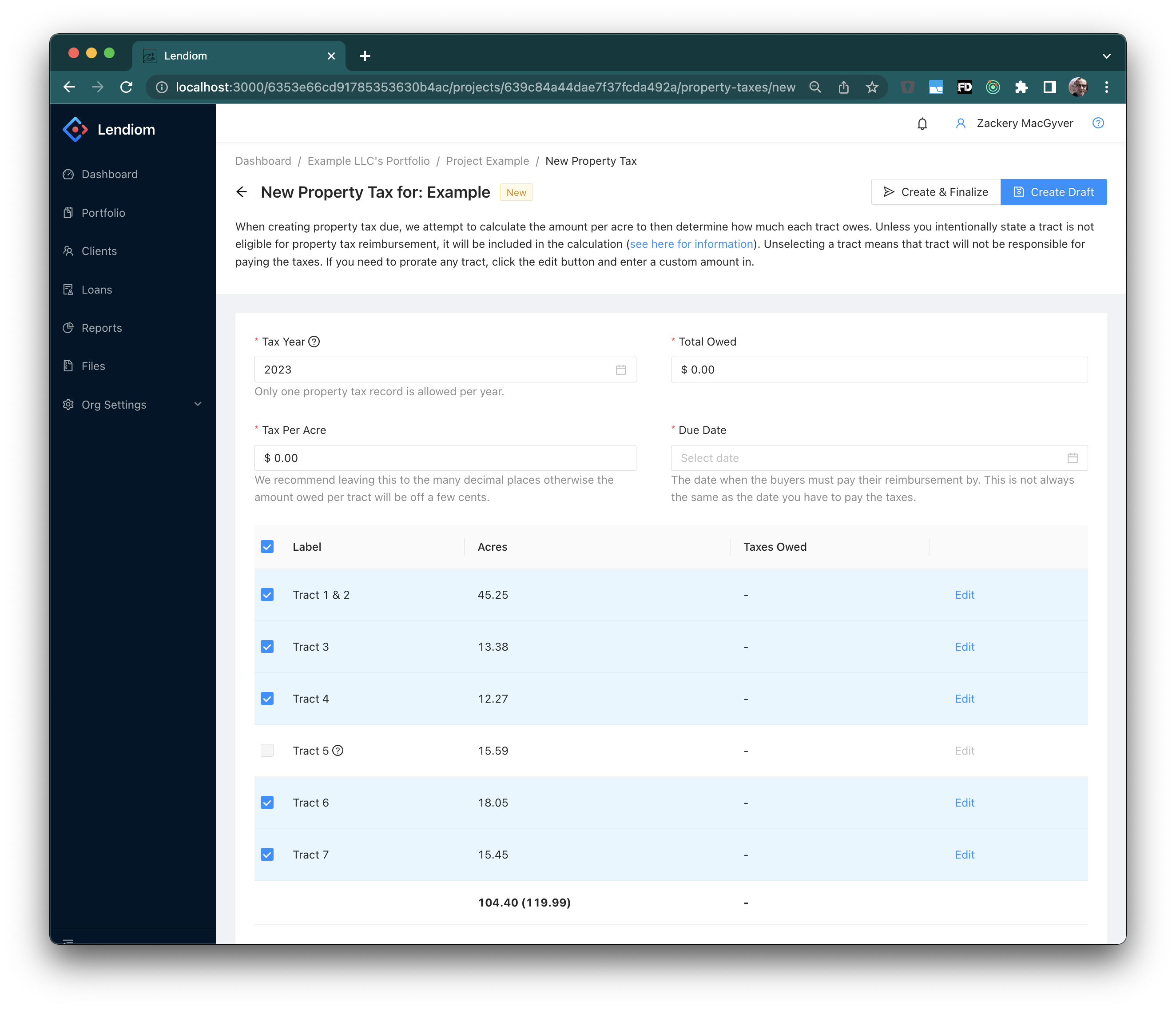

When you click the new button, a new form opens which requests all of the information we need regarding the property tax:

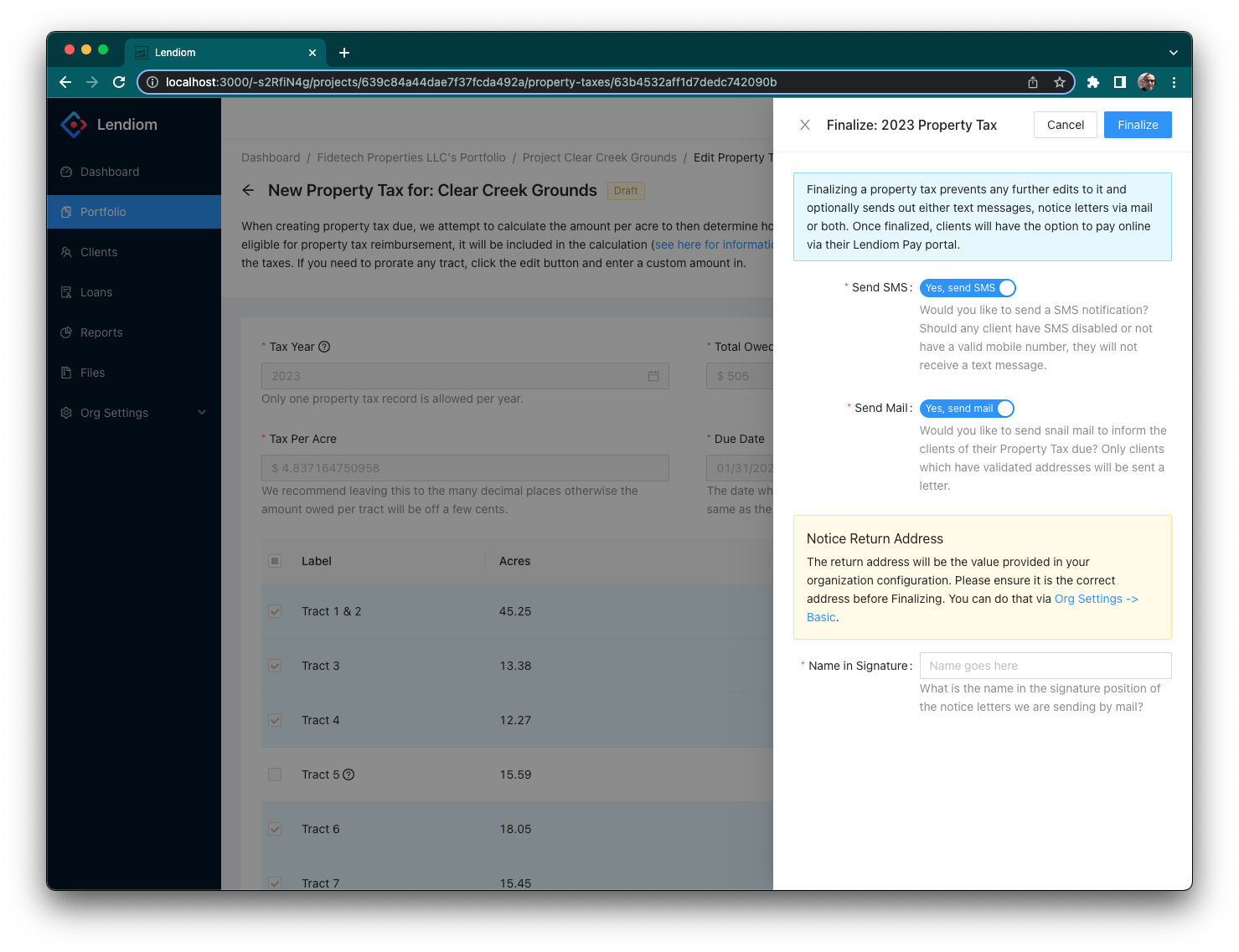

Once created, the last step is to finalize the Property Tax and send the notices. From the finalize screen, you tell Lendiom if you want to send text message notices or letters via the mail or both. When sending a letter via the mail, a name for the signature is required.

After the Property Tax is finalized, then all you have you to do is wait for everyone to pay or manually record their payments.

For more information on the various information, please see the Property Tax Guide.